The signs have been clear for a while, but the COVID bubble has officially burst for Conagra Brands. The Chicago-based manufacturer of Slim Jims and Healthy Choice frozen meals saw revenues climb to $12.3 billion last year, an increase of thirty percent from before the pandemic. However, the bubble would eventually burst, and it finally did. In its fourth quarter, the company saw sales increase just 2% on the back of aggressive price hikes. Meanwhile, consumers finally signaled they've had enough. Volumes cratered across the board.

Conagra joined the ranks of General Mills and other food manufacturers, who are now projecting a slowdown for the foreseeable future. In 2024 management projects growth of just 1%--which more or less mimics the path the company was on before the pandemic. Adjusting for inflation, that's a decrease. "People aren't eating less," CEO Sean Connolly said, "So it's -- they're making choices to manage their budget."

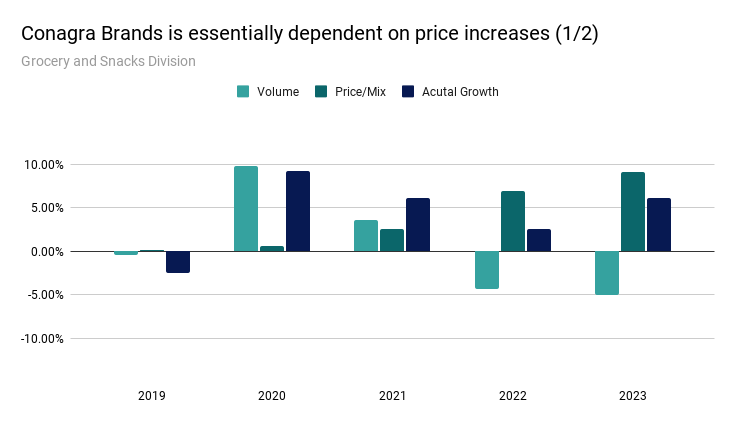

Those choices are really in reaction to Conagra's past pricing action. In the last two years, management has aggressively raised prices across its two major divisions: Grocery / Snacks and Refrigerated / Frozen.

Unit volumes held fairly strong until recently.

I've written about how the company has done an incredible job premiumizing its frozen portfolio—raising the average price of a Healthy Choice frozen meal from under $2.50 to over $4.00. People showed they would pay more for a better product, but the company finally found its breaking point.

In 2023, division volume plummeted by over 11%.

"We've seen this dynamic since just after Easter," Connolly said. "And importantly, where we see it, it is usually not a trade down to lower-priced alternatives within the category. Rather, it's an overall category slowdown."

To management, the answer isn't to lower prices to gain back some volume; it's a mixture of raising prices through continued premiumization and expanding margins through productivity programs. As they signaled in CAGNY, the company will continue to replace veggies in bags with veggies in bags with sauce—while driving efficiencies throughout the system.

I've been fairly complimentary to Conagra, but now we'll find out if it was misguided.

Management is trying to spin 2023 as a success…Wall Street isn't sold

Management said it accomplished its three goals: margin recovery, supply chain improvement, and paying down debt.

To their credit, margins are up, the supply chain is operating at 95%, and it has less debt—but Wall Street wasn't impressed. Conagra's stock dropped about a dollar a share after the news.

Facing the pressure, management went analytical

Connolly argued that while volumes are lower overall, a more granular analytical approach is needed to understand how consumers judge the value of specific brands and products. Translation: We've lost volume, but in the places we are building our brands, we're doing fine.

Internal Elasticity analytics show a soft response compared to historical price increases. However, consumers are buying less for a period.

Promotional Strategy Update

Conagra wants to increase category-building promotions with positive ROI as supply chains stabilize above 95%. This includes targeted holiday promotions and high-ROI initiatives like fish promotions during the Lenten season.

In my experience, these can be hard to sell-in--especially facing skeptical retailers.

Conagra wants to shift away from deep discounts, low-ROI promotions that train shoppers to buy based on deals.

Easy to say, harder to execute when competitors launch them.

They said it:

CEO Sean Connolly explains the company’s approach to elasticities:

Elasticity analytics measure a consumer demand response to a change in pricing at a brand level and in a time period following that pricing action. And those analyses have consistently, including recently, shown consumer response to brand-level pricing actions has been benign compared to historical norms.

That remains true for Conagra. It remains true for our peer set. As I mentioned in my prepared remarks, our elasticities, they softened a little in Q4, but they remain benign versus historical norms, and they are directionally ahead of the peer groups.

The behavior shift I referenced, are a bit of a different animal. It's not a consumer response to a particular brand's pricing action, rather it is a set of coping tactics, more broadly, to the overall higher cost environment. These tactics include things like just buying less for a period of time, the stuff I talked about there.

So you may look at that and say, "Well, the net of them both is that volumes are lower." That's true. But if you really want to get into analytically really, what consumers are judging the value of a specific brand and product, you got to get into the more granular analytics, whole science. And if you want to understand just the more macro consumer attitude and how they're coping with the cumulative effect of higher prices, that is you're going to get to different conclusions.