Dollar General is reeling from its low wage strategy

Same-store sales are down, and margins are about to get tighter.

When a CEO starts a meeting by emphasizing 'getting back to the basics' in stores, supply chains, and merchandising, it often signals a troublesome quarter.

That's exactly what happened with Dollar General.

Dollar General's net sales increased 2.4% to $9.7 billion due to 263 new store openings. However, the discount retail giant observed a 1.3% decline in same-store sales, driven by fewer items sold per transaction and declines across all product categories. Gross profit margins also fell to 29% — a 147 basis point drop, mainly due to higher shrinkage and increased markdowns.

Basically, existing stores sold less, at worse margins, and they lost a ton of sales.

Labor issues are at the heart of Dollar General's current woes. Mainly, an entire business model is built on poorly paid and staffed locations. The company is pouring an extra $150 million yearly into store labor to combat various issues (theft and overall bad vibes).

This step is crucial, especially as studies reveal that 92% of the workforce earns less than $15 an hour, placing Dollar General at the bottom in wage rates compared to other large service sector employers. Compounding these difficulties are severe out-of-stock problems, the worst in over 15 years, largely stemming from labor cost challenges.

If you don't hire employees, your inventory sits in the back, not on shelves. Their metrics are the worst they have been in over 15 years.

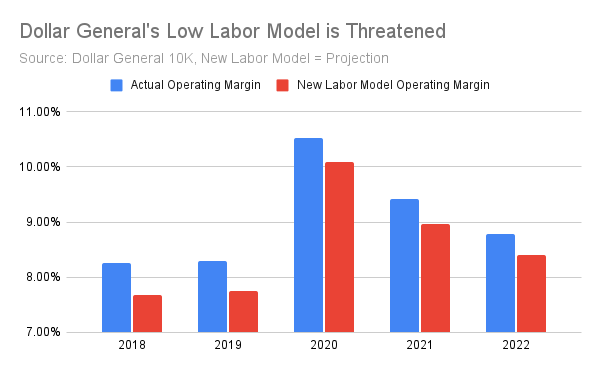

Dollar General, known for 8-10% operating margins, faces a significant challenge with the extra $150 million labor investment. By contrast, competitors like Walmart operate with margins below 5%. A back envelope calculation shows that the additional labor cost necessary for the company to function could reduce its operating margin by about half a percentage point.

Scaling Down Self Check-out

While self-checkout offers convenience, it is being repositioned as a secondary option, emphasizing the value of personal interaction and check-out assistance for an improved customer experience.

“We should be using self-checkout as a secondary checkout vehicle, not a primary,” CEO Todd Vasos said.

The Company is going to slow down new stores…for now

High-interest rates and construction inflation is slowly down expansion.

“Why not take a little bit of a step back in new store development, give our teams the opportunity to also get a lower cost to put these buildings in,” Vasos said.

They said it:

CEO Todd Vasos on investing $150m more on labor.

That redeployment of money from the smart teams directly into our store where it touches our customer each and every day immediately is so important, and that's exactly what we're going to do. And as we do that, and I think it's very important to point out, it also helps the front end of that store.**

And it helps on the sales line because we've got somebody to meet, greet and ring up the customer. It also helps on the shrink line because you've got somebody at the front end of the store that is always there to monitor the front end of the store.**

And also, it helps on the convenience side because we had relied and start to reply too much this year on self-checkout in our stores. We should be using self-checkout as a secondary checkout vehicle, not a primary. And so with all that, it's really going to help. And then when you focus in on our supply chain, getting the right product at the right time to our stores or OTIF in full and on time, I would tell you that that's going to make a world of difference.