PepsiCo's Q2 Revenue Hits $22.3 Billion, Fueled by Soda and Salty Snacks

Analysts and Executives are torn on the scope of price increases

Price doesn't seem to matter that much when it comes to soda and salty snacks.

Last week, PepsiCo Inc. increased its 2023 sales estimates, further solidifying a split between the pricing power of individual consumer goods brands and categories.

The consumer goods industry experienced unparalleled success throughout the pandemic. Now, the fates of consumer goods manufacturers are diverging. Consumers have repeatedly shown that they're willing to pay more for quiet luxuries like salty snacks while skimping on more commodity driven products. Earlier this month, cereal and flour giant General Mills revised guidance down. Kellogg upped the ante behind their powerful Cheez-Its and Rice Krispies brands.

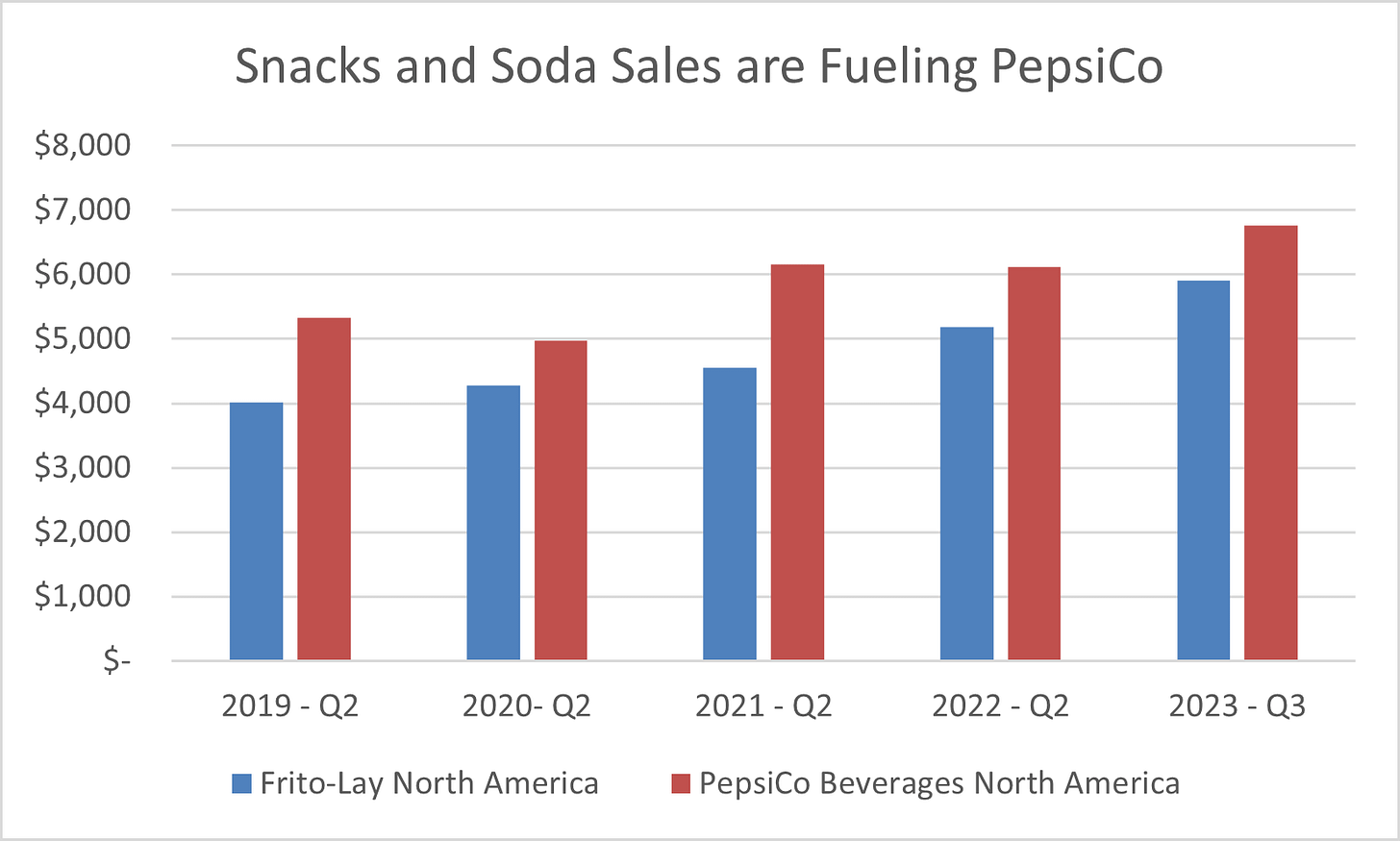

Overall revenue at the PepsiCo grew 10.4%, reaching $22.3 billion in the second quarter. Organic revenue, which factors in currency fluctuations and acquisitions/divestitures, surged 13%.

The big drivers were soda and salty snacks. Frito-Lay, the North American snacks unit responsible for brands like Sun Chips and Doritos, is up 14%. Its PepsiCo beverage business, which includes all the Pepsi and Mountain Dew sold in North America, saw a 10% revenue boost. Operating margins for both groups are down but stabilizing from the pre-pandemic era.

"We are very pleased with our performance for the second quarter as our business momentum remains strong." PepsiCo CEO Ramon Laguarta said in a statement. "As a result, we now expect our full-year organic revenue to increase 10 percent (up from 8 percent) and our core constant currency EPS to increase 12 percent (previously 9 percent)."

There's a disconnect between what's driving the margin growth.

On the earnings call, Wells Fargo Analysts said the company added about a 2% cost increase on top of inflation. PepsiCo Executives disagreed, arguing that the 15% price increase for the quarter is essentially equal to commodity inflation. Impossible to tell whose right based on public data.

PepsiCo management attributes around a percentage point of gross margin to "things like digitalization and in automation and then leveraging global business services to standardize how we operate."

Direct-Store-Delivery Model is a competitive asset.

Direct-Store-Delivery (DSD) is when a manufacturer delivers products directly to retailers and stocks the shelves. Typically, drivers double as salespeople, giving the company direct control over its in-store product and on-the-ground insights into the market. DSD is very expensive to operate—Dr. Pepper-Keurig views it as a platform.

Management credits the DSD model for expanding distribution and a double-digit sales increase for Gatorade.

The network has helped make the CELSIUS brand a runaway hit—giving distribution to the start-up energy drink.

The Consumer is, of course, adjusting to higher prices.

PepsiCo credits its marketing and commercial teams for ensuring most consumers remain loyal to the company's categories and brands at higher prices.

However, consumers are changing their shopping habits—including multiple trips and migrating to the dollar and club channel.

They said it:

CEO Ramon Laguarta on how consumers are adapting to higher prices:

And that has continued to be during the first half of the year, even though we're seeing lower income consumers strategizing around, obviously, optimizing their budgets. But we're seeing the majority of consumers staying within our categories, staying within our brands and it's remarkable what our marketing teams are, commercial teams have been doing to minimize elasticity. In some respect it is what we have been investing for the last few years. Our brands are stronger. The perceived value of our products is better than it was. And obviously, we've been able to raise prices and consumers stay within our brands. Now we're seeing consumers making some adjustments. We're seeing consumers shopping in more stores than before. They're looking for better deals.